Strategic diversification to help meet your clients’ financial goals

Empire Life Canoe Portfolio GIFs are a new suite of segregated funds that can help your clients reach their financial goals by utilizing long-term strategic allocation based on factors such as life stage, risk tolerance, time horizon and investment objective. The portfolios benefit from the portfolio management expertise of Empire Life Investments Inc. and Canoe Financial.

Empire Life Canoe Portfolio GIFs are a powerful combination of portfolio management by Empire Life Investments and Canoe Financial. They are constructed by taking a long-term strategic view of the market and diversifying across investment styles, industries, regions and categories.

Empire Life Canoe Portfolio GIFs: Construction and solution

Strategic allocation

|

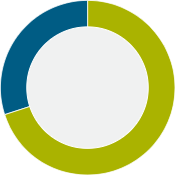

Empire Life Canoe Conservative Portfolio GIF* |

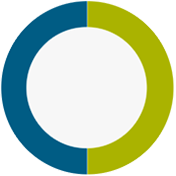

Empire Life Canoe Balanced Portfolio GIF* |

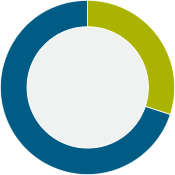

Empire Life Canoe Moderate Growth Portfolio GIF* |

| Target Asset Mix |

70% Fixed Income and 30% Equity |

50% Fixed Income and 50% Equity | 30% Fixed Income and 70% Equity |

Underlying funds |

|||

| Canoe Equity Portfolio Class | 10% | 20% | 30% |

| Empire Life Global Equity GIF | 15% | 20% | 20% |

| Canoe Global Equity Fund | 5% | 10% | 20% |

| Empire Life Strategic Corporate Bond Fund | 10% | 10% | 13% |

| Canoe Global Income Fund | 25% | 20% | 13% |

| Canoe Bond Advantage Fund | 35% | 20% | 5% |

*This is the marketing name for the fund. The fund’s legal name excludes “Empire Life” and “GIF” and includes “Canoe EL” at the start and “Protection Portfolio” at the end of its name. As at Dec 31, 2022. Due to rounding totals may not add up to 100%.

What are the benefits of Empire Life Canoe Portfolio GIFs?

- Professionally managed investment solutions. The portfolios are strategically allocated to leverage the investment expertise of Canoe Financial and Empire Life Investments Inc.—both award-winning1 Canadian fund managers—to help your clients meet their financial goals.

- Diversification in an instant. The portfolios are fully diversified across several regions, sectors and investment types.

- Strategic asset allocation. Each portfolio is expertly constructed and managed, to better align with the different risk profiles and time horizons of a range of clients.

- Valuable protection and estate planning. With valuable features only available in an insurance contract, such as maturity and death benefit guarantees, the ability to bypass estate and avoid probate fees along with potential creditor protection, segregated fund contracts can give your clients greater peace of mind.

Marketing Materials for Advisors

Marketing Materials for Clients

- Empire Life Canoe Portfolio GIF consumer brochure (INV-3760)

- Empire Life Canoe Portfolio GIF – Quarterly Commentary

Points of Sale Materials

- Empire Life GIF 75/75, 75/100 and 100/100:

- You can find the applications on our Printable Applications page. These include:

- Application for Empire Life Guaranteed Investment Funds (Empire Life GIF) (INV-911)

- Empire Life Guaranteed Investment Funds (Empire Life GIF) Application for a Nominee/Intermediary Account (INV-912)

- Empire Life Guaranteed Investment Funds (Empire Life GIF) Application for a Tax-Free Savings Account (TFSA) (INV-913)

- Empire Life Guaranteed Investment Funds Information Folder and Contract Provisions (INV-943)

- Guaranteed Investment Funds - Individual Fund Facts Page

- You can find the applications on our Printable Applications page. These include:

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value.

1 Empire Life won two 2022 Fundata FundGrade A+ Awards for the Empire Life Asset Allocation GIF and Empire Life Short Term High Income GIF. Canoe Financial won two 2022 Fundata FundGrade A+ Awards for the Canoe Equity Portfolio Class and Canoe Global Equity Fund. Canoe Financial won the 2022 Lipper Fund Awards for Best Mixed Assets Group over 3 years, Best Canadian Focused Equity Fund over 3 years, Best Tactical Balanced Fund over 3 years and Best Global Neutral Balanced Fund over 3 years.

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

Refinitiv Lipper Fund Awards, ©2022 Refinitiv. All rights reserved. Used under license. The Refinitiv Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. The highest 20% of funds in each category are named Lipper Leaders for Consistent Return and receive a score of 5, the next 20% receive a score of 4, the middle 20% are scored 3, the next 20% are scored 2, and the lowest 20% are scored 1. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the Refinitiv Lipper Fund Award. For more information, see lipperfundawards.com. Although Refinitiv Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Refinitiv Lipper. Lipper Leader ratings are subject to change monthly. Canoe Asset Allocation Portfolio Class Series F was awarded the 2022 Refinitiv Lipper Fund Award in the tactical balanced category for three years ending July 31, 2022, out of a classification total of 53 funds. The corresponding Lipper Leader ratings of the Fund for the same period are as follows: N/A (one year), 5 (three years), 5 (five years), 5 (ten years). Canoe Equity Portfolio Class Series F was awarded the 2022 Refinitiv Lipper Fund Award in the Canadian focused equity category for three years ending July 31, 2022, out of a classification total of 65 funds. The corresponding Lipper Leader ratings of the Fund for the same period are as follows: N/A (one year), 5 (three years), 5 (five years), 4 (ten years). Canoe North American Monthly Income Portfolio Class Series F was awarded the 2022 Refinitiv Lipper Fund Award in the global neutral balanced category for three years ending July 31, 2022, out of a classification total of 178 funds.