Empire Life differentiators series

Advisors are interested to understand what makes one insurance carrier different from the next—beyond price. You hear similar stories from many carriers and need to understand each carrier’s strengths in order to make a recommendation for your customers’ business.

Advisors consistently single out the strength of the Empire Life ASO (Administrative Services Only) offer as a differentiator in the market.

What makes ASO at Empire Life stand out? According to Dara Brachman, Vice President of Group Distribution, “Our Advisors tell us that they find several of our features helpful—including budgeted rates, split funding, ASO dental available down to 2 lives and EHB down to 20 lives —combined with quarterly statements, an efficient deficit/surplus process, and competitive fees. At the same time, when an in–force Empire Life policy switches from a fully insured offer to ASO, we do all the work behind the scenes so there is no impact on the plan administrator or plan member's experience. The policy and certificate numbers remain the same."

What is ASO?

ASO stands for administrative services only. It’s a business contract under which an insurance company agrees to perform specific administrative duties for the maintenance of a health insurance plan funded by the customer.

When a customer self-funds its health benefits, Empire Life performs admin duties that can include, but are not limited to:

- Issuing the contract, employee benefits booklets, and benefit cards

- Sending monthly billing statements

- Administering employee onboarding, salary changes, life events, etc

- Adjudicating and paying claims

- Reconciling statements

- Fraud detection and prevention

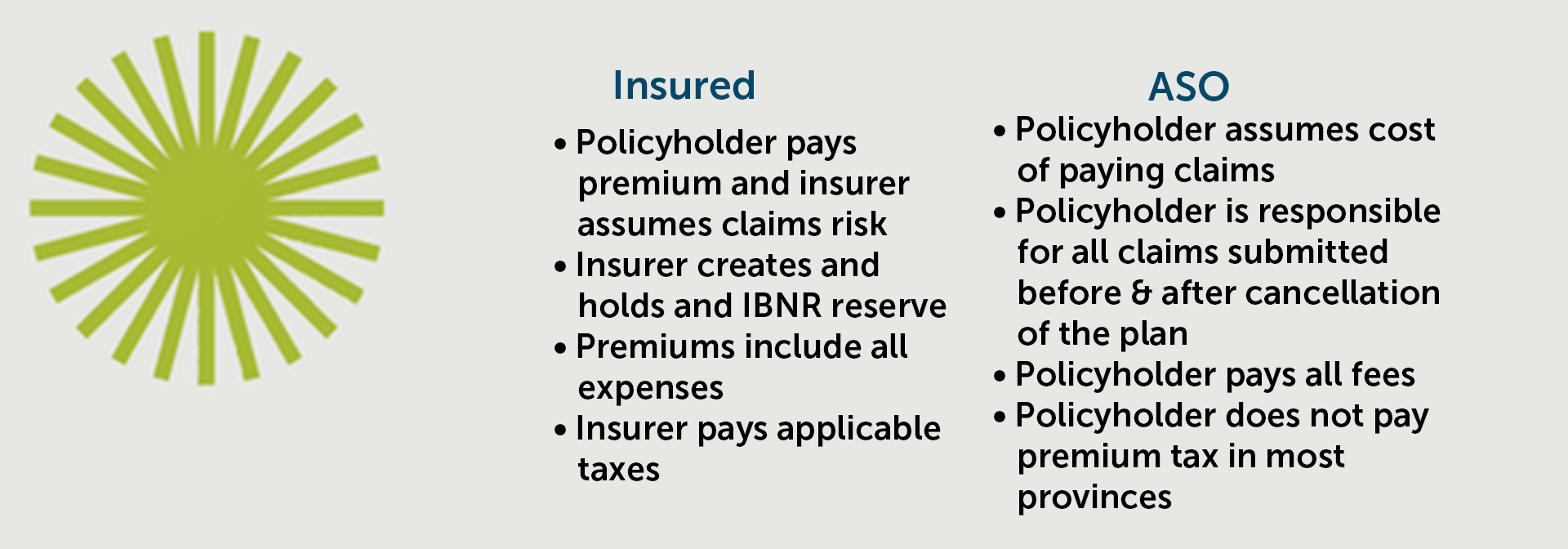

Unlike an insured plan, in which all of the risk remains with the insurer, the customer assumes some of the risk under an ASO plan.

To provide flexibility, Empire Life offers a budgeted approach, billing the customer a monthly rate similar to an insured plan, then reconciling the account monthly or quarterly. There is also an annual reconciliation at renewal.

A number of items are factored into ASO expenses, including:

- Claims administration costs

- General administration costs

- Risk charge

- Commissions paid to advisors

- Premium tax (except in Alberta)

- Stop-loss charges

- Out of country pooling charges

ASO expenses can be billed as a percentage of premium/deposits or a percentage of paid claims. Expenses presented as a percentage of premiums/deposits, if consistent, allow the client to budget accurately. Expenses will not vary unless the premium/deposits vary. If expenses are presented as a percentage of claims, the monthly ASO expenses will vary as the claims vary.

ASO is not for every group

Advisors need to carefully consider the risks when deciding whether ASO is a good fit for their customers.

Risks can include:

- Changes in claims patterns (e.g. organizational changes at the policyholder)

- Catastrophic claims (e.g. COVID epidemic)

- Government offloading of health services

- New product/services (e.g. new drug therapies)

- Litigation

There are several ways to manage ASO risks, including:

- Pooling: large, unexpected types of claims (e.g. out-of-country, accidental dental, medical appliances)

- Stop loss: Insure any claims above a benchmark for each insured person (e.g. $10,000)

- Plan designs: Include internal plan maximums (e.g. limit paramedical expenses to $500/year)

- Empire Life bases EHB pooled pricing rates on a percentage of the ASO budgeted rates. This helps minimize volatility compared to other approaches such as basing rates on a percentage of reimbursed claims at the end of the analyzed experience period.

While ASO is not for every customer, there are many advantages for groups that are able to assume some of the risk, including lower plan charges; premium tax savings; and management of cash flow.

Is ASO the right choice?

It is for many groups. It’s especially well-suited to customers with low employee turnover and whose business allows them to take a long term management approach to their insurance experience in much the same way they manage their overall operational budget.

Advisors are best placed to help customers evaluate their risk tolerance and decide if they are willing and able to assume more financial responsibility and cover any plan deficits when they occur.

Like to learn more?

Advisors can reach out to their Empire Life account team, and customers can talk to their group plan advisors