The Ultimate Guide to Generating Retirement Income in Canada

Most Canadians are concerned about retirement income. In fact, over 90% of aging Canadians tell us that: 1

- People want predictable income

- They are willing to contribute more to ensure it

- They want a lifetime income

- They are willing to pay more to guarantee a secure lifetime retirement income

People don’t want to risk losing these four things and risk making mistakes. As we age, there is less room for error and less time for recovery. Guarantees naturally become more desirable.

For most people, government benefits and, if available, company pension plans, will provide a guaranteed base level of income. Investments and other assets need to generate the extra income which will provide the lifestyle retirees envision or expect. You, together with your financial advisor, should seek answers to the following questions:

- How much income can be generated on a sustainable basis?

- How long will that income last?

- Will that income be enough to cover fixed, variable and increasing expenses?

- Can the assumptions used withstand stress testing so that even under adverse conditions there will be enough sustainable income to cover basic and lifestyle expenses?

The need for contingency planning

These questions point to the need for contingency planning and managing your risk (to address poor health, illnesses and premature death) and covering these with products that may provide the right amount of money to meet those needs – like various insurance solutions. What options do Canadian retirees have for generating retirement income, let alone have at least some of that income guaranteed for life?

Government-Sponsored Retirement Plans

Canada Pension Plan (CPP) and/or Quebec Pension Plan (QPP)

- The Canada Pension Plan is a major source of most Canadians’ retirement income, and is therefore, one of the most important aspects of their retirement planning. For those who work (or did work at some point) in Quebec, they may be eligible for the Quebec Pension Plan.

- In order to estimate how much income/cash flow you may need for retirement privately, calculate how much you can expect to receive in CPP/QPP payments.

- There are many factors that impact your potential CPP/QPP payment amount, including:

- The age at which you hope to retire

- How much you’ve contributed to the CPP/QPP

- Whether or not you qualify for additional provisions

- The number of variables makes it difficult to determine an exact payment amount. In order to help Canadians plan more accurately for retirement, the CPP provides an average payment amount and the maximum payment amount, adjusted annually for inflation and cost of living.

- In 2019, the maximum CPP/QPP payment is $1,154.58. However, the average payment is much lower: $664.41 (if taken at age 65).

- Remember that applying for CPP/QPP payments prior to age 65 permanently reduces your possible pension by 0.6% per month. If you begin taking your payments as early as possible (age 60), you’ll take a 36% cut overall.

- If you’re able to continue working past age 65 and wish to postpone your CPP/QPP payments, you’re able to do so until age 70. For each month you delay payments, you’ll receive an additional 0.7% increase. If delayed until age 70, you’d receive a permanent 42% increase in your pension.

- There is no financial incentive to delaying CPP or QPP payments past the age of 70.

- Surviving spouses and common law partners may receive survivor benefits from the plan.

- CPP/QPP payments are considered taxable income, so be sure to deduct some of this amount in your retirement planning. For your convenience, you can opt to have taxes voluntarily withdrawn from your payment, which you can do in your My Service Canada Account (MSCA) or by printing and filling out Form ISP 3520 and mailing it in.

Old Age Security (OAS)

- Old Age Security is a pension plan separate from CPP/QPP for long-term Canadian residents and certain former residents. Unlike the CPP, you do not have to pay into it to get benefits out of it. You can receive benefits even if you have never worked or you are still working. In order to qualify for OAS pension payments, you must be:

- age 65 or older,

- a Canadian citizen or a legal resident at the time of approval of your OAS application, and

- a resident of Canada for at least 10 years since age 18.

- If you don’t meet these criteria, you may still qualify for OAS benefits, provided Canada has a social security agreement with your new country of residence.

- OAS pension amounts are adjusted quarterly according to the consumer price index. You can review the most recent payment amounts here.

- OAS payments are considered taxable income. Much like CPP payments, you can elect to have taxes withdrawn from your OAS pension through MSCA or Form ISP 3520.

- Once a full or partial Old Age Security pension has been approved, it may be paid indefinitely while you reside outside Canada - as long as you have lived in Canada for at least 20 years after reaching the age of 18. Otherwise, payments will be made only in the month of your departure from Canada and for six additional months thereafter.

Guaranteed Income Supplement (GIS)

- The Guaranteed Income Supplement is available to all eligible OAS recipients who have little or no other sources of income. In the second quarter of 2019, single, widowed or divorced recipients could qualify for up to $892.32 monthly. Married recipients, who both receive the full OAS pension, could each qualify for up to $540.77 monthly.

- As a recipient, you must file an income statement or complete an income tax return (filed by April 30). The CRA will review your eligibility for this benefit each year using your net income information from your income tax return or the combined net income in the case of a couple. Your benefit will be automatically renewed if you qualify. You will receive written confirmation of the decision. The amount of monthly payments received each year may increase or decrease according to reported changes in your yearly net income.

- The Guaranteed Income Supplement is not subject to income tax.

- As well, the Guaranteed Income Supplement is not payable outside Canada beyond a period of six months, regardless of how long you have lived in Canada.

If you were automatically enrolled for the OAS pension, you will be automatically enrolled for the GIS provided you are eligible. If so, you will be considered for the GIS on an annual basis, without needing to apply. If you did not receive a letter from Service Canada telling you that you were selected for automatic enrolment in OAS/GIS, then you need to complete and mail the Application for the Old Age Security Pension and the Guaranteed Income Supplement (ISP-3550)

Social Security/Government Benefits from Abroad

You may be eligible to receive social security benefits from another country where you lived and or worked. Be sure to apply for these benefits and watch how these benefits may be taxed. For instance, residents of the USA who receive CPP/QPP or OAS benefits do not pay Canadian withholding tax on those payments; benefits are only taxable in the USA. Canadian residents receiving U.S. social security benefits are not subject to U.S. withholding tax on those payments; 85% of the benefits received are taxable in Canada 3.

Registered Pension Plans (RPPs)

- Registered pension plans are the most common type of employer-sponsored pension plan.

- Employer-sponsored pension plans are becoming fewer and farther between, but some Canadian companies still offer them — and if your company is one of them, hopefully you took advantage of it.

- There are two different types of pension plans employers can offer: defined contribution and defined benefit.

- A defined contribution plan stipulates how much is contributed to the plan. These pension plans involve setting an amount the employer and the employee agree to contribute each year, based on the employee’s annual earnings. This may help reduce the amount you need to contribute to your retirement savings because your employer is footing a portion of the bill. Upon retirement, you can transfer these funds into a Registered Retirement Income Fund (RRIF), or purchase an annuity (this must be done by the end of the year in which you turn 71). It is up to you, preferably in consultation with an accredited financial advisor, to set up a lifetime income stream.

- A defined benefit plan stipulates how much lifetime income will be paid from the plan. The employer agrees to pay the employee an annual amount after they retire for as long as the employee lives and for as long as the employee’s spouse or common law partner lives, if applicable. This amount depends on how long the employee worked, how much they were paid annually during that time, which earnings count towards the calculation and whether or not the employee is married or in a recognized common law relationship.

- All payments from either type of pension plan are treated as taxable income.

Private Retirement Savings Plans

Thanks to adjustments in government and corporate pension programs, increasingly, retirement income will depend on how much people have saved and how well they manage their own money in retirement. The Canadian government, as well as financial advisors and planners, will recommend Canadians do what they can to save privately for retirement — even after factoring in CPP/QPP enhancements.

Registered Retirement Savings Plans (RRSPs)

- The most commonly used private retirement savings option is the registered retirement savings plan, or RRSP.

- Like CPP/QPP and OAS payments, RRSP withdrawals are considered taxable income.

- If you opened a registered retirement savings plan (RRSP), you can convert it into a RRIF, purchase an annuity, set up a combination of these or, cash it in (and pay taxes on the entire amount all at once).

- RRSPs must be converted into an annuity or rolled over into a registered retirement income fund (RRIF) no later than December 31st of the year you turn 71, and you must begin taking your minimum payment the following year. Once a RRIF is established, there can be no more contributions made to the plan. An annuity can provide guaranteed lifetime income, addressing concerns about outliving your income and to cover off basic, recurring expenses. You can have more than one RRIF and more than one annuity.

Pooled Registered Pension Plan (PRPP)

- A Pooled registered pension plan is another retirement savings option for Canadians. It is a retirement savings option for individuals, including self-employed individuals who do not have access to a workplace pension plan or where a workplace pension plan does not exist.

- As with RRSPs, earnings accrued are typically not subject to tax, assuming that no withdrawals are made. Amounts received from this plan are reportable and taxable.

- The Pooled Registered Pension Plans Act limits the distributions (withdrawals) that you can make to ensure that the money in your plan is there for you at retirement. The funds in your plan are generally “locked-in” and cannot be withdrawn before you retire from employment.

- A pooled registered pension plan is considered to be a defined contribution plan. That means when you retire, you must convert your plan to a Locked in Retirement Income Fund (LRIF), sometimes referred to as a life income fund (LIF) or a qualifying annuity.

Tax-Free Savings Accounts (TFSAs)

- While tax-free savings accounts aren’t traditionally considered to be retirement savings vehicles, it’s certainly possible to use them as such.

- If you don’t need all of your invested assets to generate income, consider moving some of them to a TFSA and maxing out your deposits if possible. Your investment inside a TFSA grows tax-free.

- Unlike RRSPs or RPPs, withdrawals from a TFSA are not considered taxable income and you’re not required to have earned income in order to contribute to your TFSA.

- Income coming out of a Tax Free Savings Account is not counted as income for government income tested benefits and tax credits. For example, this means that this money does not impact the amount of income you may be eligible for under Old Age Security (OAS) or the Guaranteed Income Supplement (GIS).

Do You Expect to Have Other Forms of Income in Retirement?

Will you be working in some capacity?

Some people may feel the need to work to save more money or delay having to rely on their savings for income. More and more people continue to work in some capacity to feel fulfilled, preserve a sense of purpose and identity and to keep active mentally and physically. Work is becoming an integral part of the first phase of what we still call retirement, though a better description would be financial independence.

If you are married or have a common law partner, will that person retire when you do? That will impact plans and cash flow. It’s not necessarily possible to make an accurate prediction of when you’ll retire — life circumstances can change in an instant — but it’s a good idea to have a goal in mind. If you’re unsure, stick with 65. If you reach age 65, are still able to work and want to, then you’ll be even better off. An advantage of paid work is that you can spend your earnings on your bucket list instead of spending your savings. That allows your savings to continue to grow.

Non-registered Investments and Retirement

You may have non-registered investments that can provide you with an income stream. Most will permit you to start and stop the income stream depending on what your needs are for income in a particular year.

Only Spend the Earnings on Some of Your Investments

- Guaranteed interest certificates (GICs) generate taxable interest which you can withdraw annually depending on contract terms. You can set up a series of GICs (a strategy called laddering). Laddering allows you stagger the maturities on a series of GICs. This takes the guesswork over which term will give you the best return. Each year you may withdraw capital if needed from your maturing GIC, which of course is not reportable or taxable.

- You may withdraw interest and dividends earned on investments. Dividends are payments you receive as a share of earnings from corporations in which you invest. You may cash in some investments, triggering capital gains on appreciated assets. Only the growth, not the money you invested, is taxable. The investments are cashable.

- If you own properties that you rent or lease to others, or expect to receive payments from business investments, these could be additional forms of income.

Systematically make Withdrawals and Generate Income

- You may set up systematic withdrawal plans from your investment funds. You may wish to receive a certain percentage of your assets or a set amount typically paid to you monthly or annually. You will pay tax on investment earnings and on some of the amounts you withdraw. Generally, these plans are cashable.

- Series T mutual funds offer you the opportunity to withdraw a set percentage from your investments monthly. You will receive your capital first which is not taxable. Taxable earnings are reinvested in the fund. Later, once your initial capital and tax paid growth have been paid out, your payments may be treated as capital gains. Generally, these plans are cashable.

How can I Generate Guaranteed Lifetime Income?

- You may not have a defined benefit pension plan or not be eligible for maximum government retirement benefits. This may create a gap in the amount of guaranteed lifetime income you desire.

- There is an ever increasing onus on individuals to ensure they structure their personal, long- term assets in such a way that they have sustainable, secure income through the various stages of retirement. Canadians also need to assume personal responsibility for ensuring that a portion of that income is guaranteed, freeing up their worries, the worries of their partners, children and those who may need to step in and manage their financial affairs due to incapacity. It’s no small wonder then that the interest in guaranteed lifetime income and its importance to aging Canadians is growing rapidly.

- 2/3 of people aged 55-75 like the idea of guaranteed lifetime income and 80% of Canadians see it as highly valuable supplement to government benefits.2

- There are two investment options that can provide you with contractually guaranteed lifetime income.

Pensionizing some of your assets

- You may pensionize some of your non-registered assets by purchasing a prescribed annuity. Only the interest portion is taxable. Both the payment and the taxable amount remain the same for life. You may ladder your purchases as well, taking the guesswork over when you will get the best return and matching them up with fixed expenses. Amounts not invested give you access to capital if needed. Although, these plans are typically not cashable, you may want to consider an Insured Annuity strategy which can provide you with a lifetime income and provide a legacy for your heirs and favourite causes.

- Guaranteed Withdrawal Benefits

- You may consider a guaranteed withdrawal benefit policy. This investment can provide you with a guaranteed percentage of your investment for life. The older you are, the higher the percentage payout. You may withdraw fixed amounts. You may start and stop payments. Interest is fully taxed; there are reduced taxes on dividends and realized capital gains and losses. Payouts may be largely capital gains and there is no tax on return of capital. Invested money allows you to continue to participate in potential growth in the markets, which in turn may boost your payments. This plan is cashable. Again, both an annuity and a guaranteed withdrawal plan can provide guaranteed lifetime income, addressing concerns about outliving your income and to cover off basic, recurring expenses. In both cases, only part of the income is taxable.

What about using Home Equity as cash flow or “income”?

While many people approaching retirement age may have good reason to complain about the investment climate they’ve endured, there is one area that has held up relatively well: real estate. Long-time homeowners have had an opportunity to build significant wealth without really trying – that in turn gives them more options in retirement.

If you own an expensive home, you can add to your cash savings by downsizing or relocating. If downsizing or relocating is not possible, a home equity loan or a Canadian reverse mortgage may be used to unlock some of your home’s appreciated value.

The equity in your home may provide a back-up plan if you run low on savings. Later in life, if you move to a retirement complex or a long-term care facility, the value of your home can defray long-term care costs either by setting up a home equity line of credit, selling it outright or setting up a reverse mortgage.

Reverse Mortgages

If you are a Canadian homeowner age 55+, you can get up to 50% of your home’s value through a reverse mortgage. You are not required to make any mortgage payments and you don’t have to pay any principal or interest until you sell the home or die. The mortgage is paid off from the proceeds of the home’s sale.

Another feature of the program is the “no negative equity guarantee”. This means that regardless of how much interest you accrue on your loan, you will never owe more than the house is worth – that’s valuable in the event that housing prices drop dramatically.

All money that you receive is tax-free. Canadian reverse mortgages do not affect eligibility for Old Age Security or the Guaranteed Income Supplement.

Other Income Considerations

What income figure should I focus on?

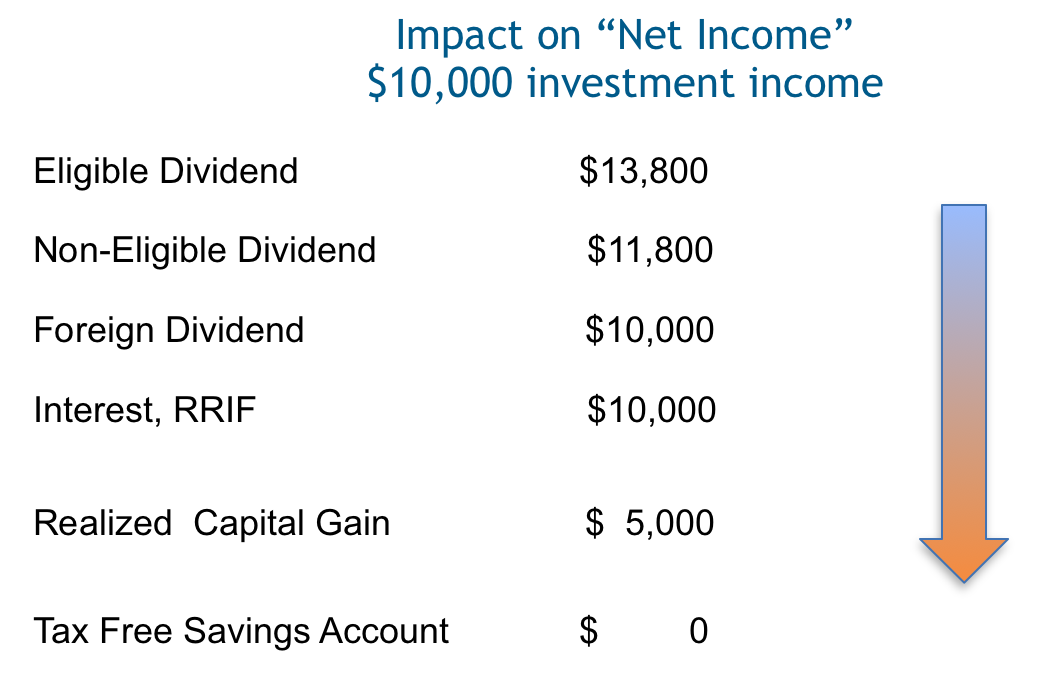

Pay attention to “net income”. That’s the amount of money you have to spend after expenses and taxes. For retirees, your net income calculation:

- determines the level of most government benefits/credits

- determines the “income” upon which tax is payable

- determines the amount of OAS/GIS claw back/reductions

- is used in the assessment of long term care per diems

- can factor into provincial pharma-care benefits

Let’s consider the following types of investment income and how much of each type may be reportable for tax purposes as net income. The income amount is the same in all cases. The amount that may be subject to income taxes and calculations on eligibility for most government benefits can vary. Income is reported on your T3 and T5 slips each year.

Consider income tax on cash flows from investable assets, government programs and company benefits, if any. The focus should be on spendable cash flow and cash flow that is regular, reliable and responsive to your particular needs, particularly for guaranteed income that may be needed for a lifetime.

When most of you were working, you relied on one or two sources of income; your earnings from work and that of your spouse or partner. Aging individuals are faced with increasing complexity involved in coordinating an increasing number of potential income sources which may come in at different times, are taxed differently, have different levels of guarantees, have varying degrees of flexibility and involve different levels of involvement by people.

Coupled with that are the risks of losing invested money or not making the returns you need. You want to get this right as soon as possible and protect yourself against the downside by engaging the services of accredited financial advisors versed and trained in the specialty of retirement income planning.

And yes, retirees still need to invest for their future, which can last 30-40 years.

Getting Retirement Planning Help

Empire can help you determine how much income you will have in retirement with our Retirement and Savings Tool.

It’s simple, it’s fast, and it’s easy. Share the results with your advisor and get the conversation started. If you don’t have an advisor, we can connect you with an advisor.

Note: please click on highlighted text for links to related material for more information.

1 Source: Designing retirement schemes Canadians want:…; Apr. 13, 2017

2 Source: 2018 Canadian Guaranteed Lifetime Income Study, Greenwald & Associates and CANNEX

3 Government of Canada, Completing a Tax Return, Line 256 - Exempt foreign income

Policies are offered by The Empire Life Insurance Company

® Registered Trademark of The Empire Life Insurance Company

The information contained herein is based on material believed to be reliable, but is not guaranteed to be accurate or complete. This is for information purposes only and is not intended to provide individual financial, legal, tax, accounting, or other advice. Empire Life is not liable for any errors or omissions in the information or for any loss or damage suffered. Please seek professional advice before making any decisions.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value.